If you read my previous blog, you knew that we purchased a lot thru BPI Home Loan.

To release the proceeds to the seller,one of the requirements is having the title of the property on your name.

The following steps are base on my experience. Feel free to comment below your experience that might help other fellow readers.

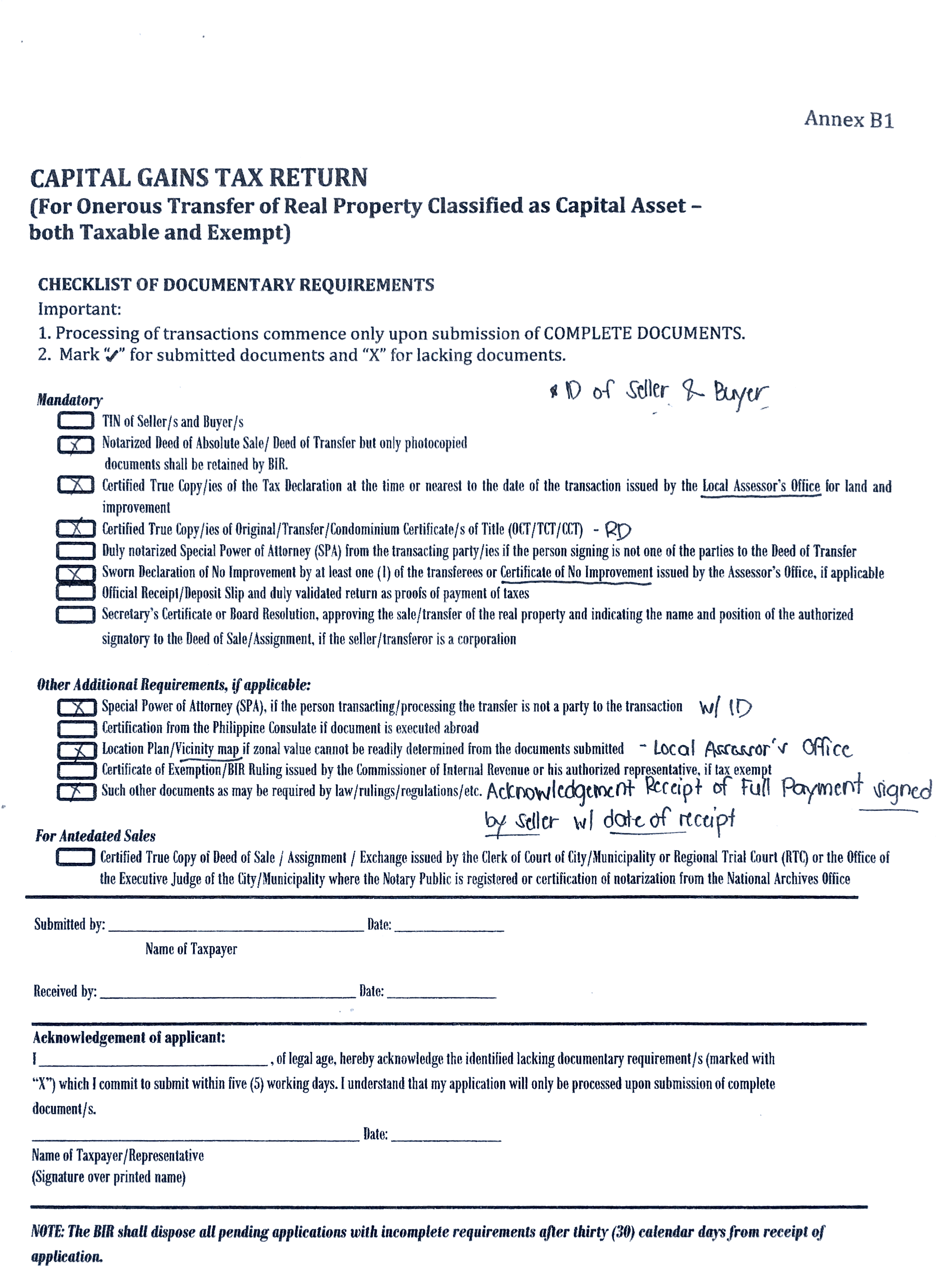

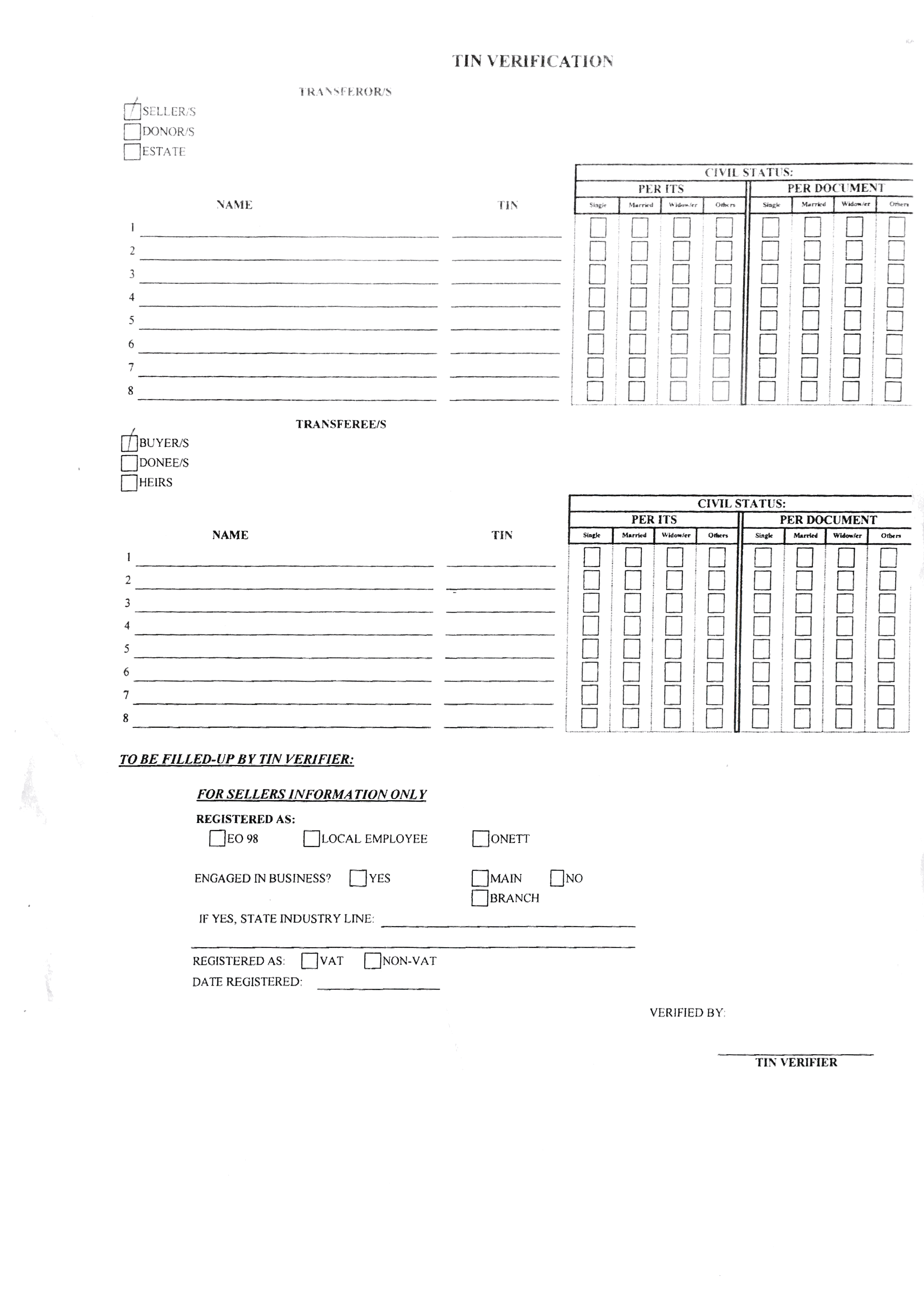

1.Go to BIR and get CAR (Certificate Authorizing Registration) Checklist. You will be asked here if you are buying the property from the bank,subdivision or just on a local person. This step is for buying a property from a local person. If your buying from a bank,subdivision or any other entity the process might be different.

2. In making Notarized Deed of Absolute Sale make sure to check the spellings of your names , ID number because the secretary is using their format and might forget to delete the information of previous client. The name that will appear on the Notarized Deed of Absolute Sale should be the exact name format written on the title.

- Example : Title : Spouses Aaa B. Ccc and Ddd E. Ccc

- Notarized Deed of Absolute Sale : Spouses Aaa B. Ccc and Ddd E. Ccc

Best if you have your own draft of Notarized Deed of Absolute Sale because it is cheaper than making them in Law Office.

- Own Draft- P350

- Law Office Draft- 650

- Notary Fee – 0.01% of Selling Price

3.Certified True Copy of Title

- Go to Registry of Deeds (RD)

- Request Certified True Copy Of Title

- Pay P273.35 for Assessment Form and Payment Order

- Go back after 3 working days

To follow up the documents : TEXT ONLY NO CALLS. This is for RD Tanauan City,Batangas ONLY

- EPEB No.- You can find these on Assessment Form and Payment Order

- Presenter’s Name:

- Entry Date:

- Transaction Type:

- Then send to 09296402067 or 09560785505

4. Certified True Copy of Tax Declaration and Certificate of No Improvement from Local Assessor’s Office.

Note: We just bought a land so we need a Certificate of No Improvement. If there’s a house or building there’s a separate document for that.

Bring your old Tax Declaration for easy processing. Pay P50 for each documents. All of the said documents must be affixed the P30.00 Documentary Stamp pursuant to Section 188 of the National Internal Revenue Code by the issuing office or office of the Assessor.

5. Vicinity Map from Tax Mapping Office

Just show your Certified True Copy of Tax Declaration and Certificate of No Improvement from Local Assessor’s Office. Free of Charge. I don’t know if Documentary Stamp is needed on this document,but i affixed one to be safe.

6.SPA

If the person transacting the transfer is not related to the party. In our case, i asked the help of my sister to submit the documents to BIR, so we issued SPA.

If the seller is in abroad you need a SPA executed at the consul. In our case the husband of the seller is an OFW so before he leaves he issued marital consent with SPA to her wife.

7.Acknowledgement Receipt of full payment signed by the Seller with date of receipt.

If you already paid in full. This is not a big deal,you just need to write an acknowledgement letter. If not yet paid,Letter of Guarantee from the bank will do,if loaned in the bank.

8.Photocopied all the documents in 3 sets. (2 for the BIR, 1 for your copy)

9.Once completed,BIR will issue ONETT Computation Sheet .It is a computation of the Capital Gain Tax (CGT) and Documentary Stamp (DST) that need to pay to Accredited Agent Bank (AAB) located within the territorial jurisdiction of the Revenue District Office (RDO).

Computations Details:(As of March 28,2019)

- Capital Gain Tax

- According to the Philippine Tax Code, capital gains tax or CGT is a tax that is imposed on earnings the seller has gained from the sale of capital assets. It is charged at a flat tax rate of 6% of the gross selling price, and must be paid within 30 days after each transaction.Oct 24, 2014 https://www.lamudi.com.ph/journal/qa-what-is-capital-gains-tax-who-pays-for-it/

- Legal Basis: Section 24(D),25(A)(3)&24(D)(5)

- Area X Zone Value/sq.m X 6%

- Ex: 131 X 10,000 X 0.06= P78,600

- Values depends on the locations

- Documentary Stamp Tax

- Documentary Stamp Tax (DST) is a tax on documents, instruments, loan agreements and papers evidencing the acceptance, assignment, sale or transfer of an obligation, right or property incident thereto.https://businesstips.ph/how-to-compute-documentary-stamp-tax-dst-on-transfer-of-real-property/

- Legal Basis: Section 196 (CTRP)NIRC

- Area X Zone Value/sq.m X P15.00 for every P1,000.00 or the fraction thereof

- Ex: 131 X P10,000 / P1,000.00 X P15.00 = P19,650

- Total Amount to Pay : P78,600+P19,650=P98,250

10. Pay the Taxes to Accredited Agent Bank (AAB)https://www.bir.gov.ph/index.php/list-of-authorized-agent-banks.html for BIR Lipa RDO 059 hhttps://www.bir.gov.ph/images/bir_files/collection_programs/59_copy.pdf

11.Submit all the documents to BIR. After 2 weeks , call the contact person at the number on the Claim Slip to inquire if the CAR is ready.

Hooray! Done for step 1.

That’s what’s on Mellie’s mind. Now it’s your turn to tell me what’s on your mind.

Hope it helps!

Happy Reading!